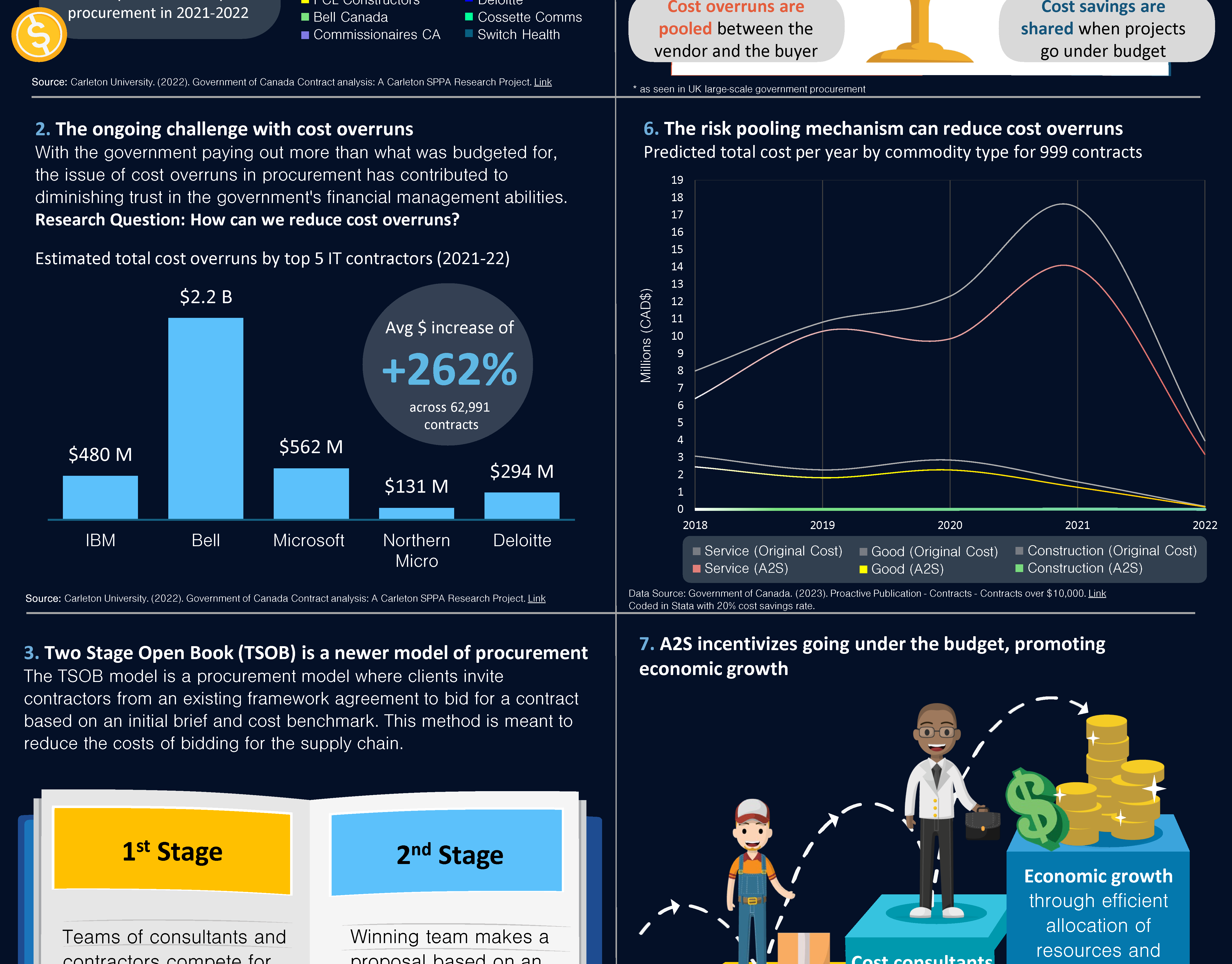

Table 1: Free text search inputs. This table reports the inputs used to obtain data from the Factiva database.

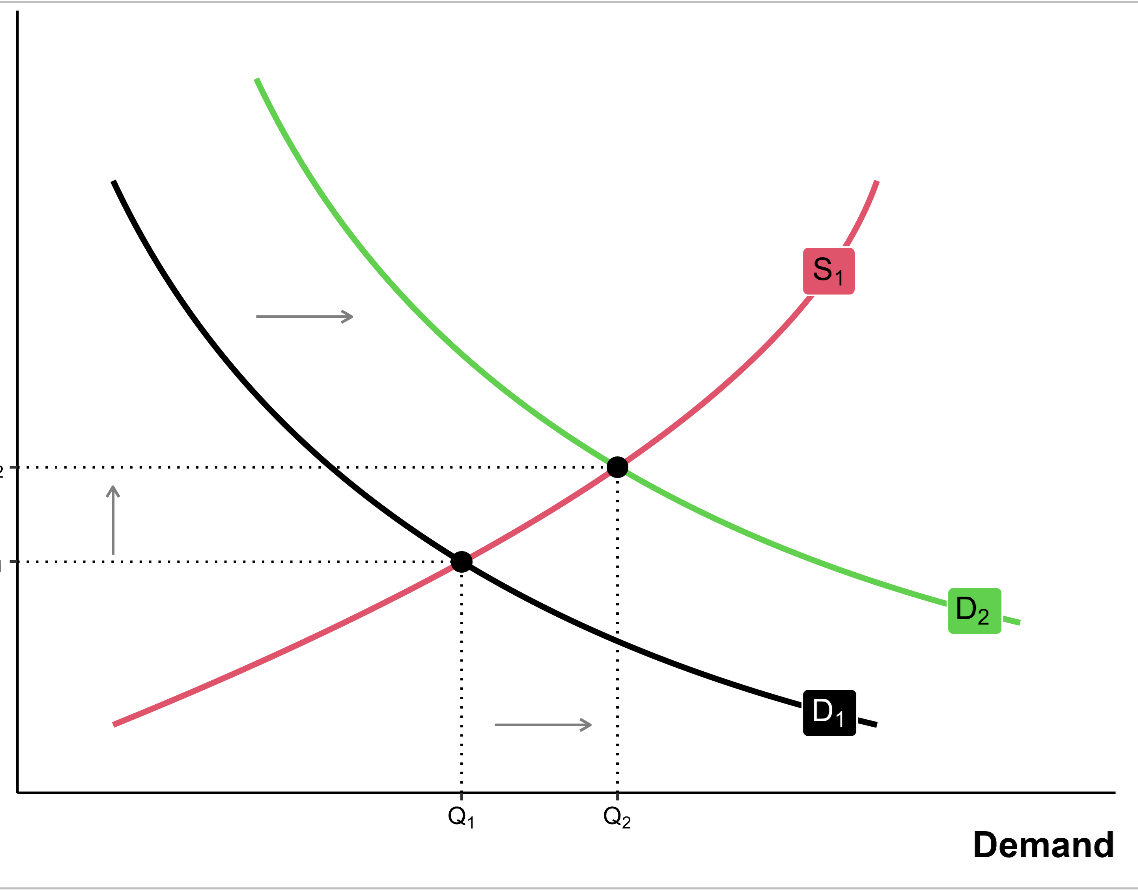

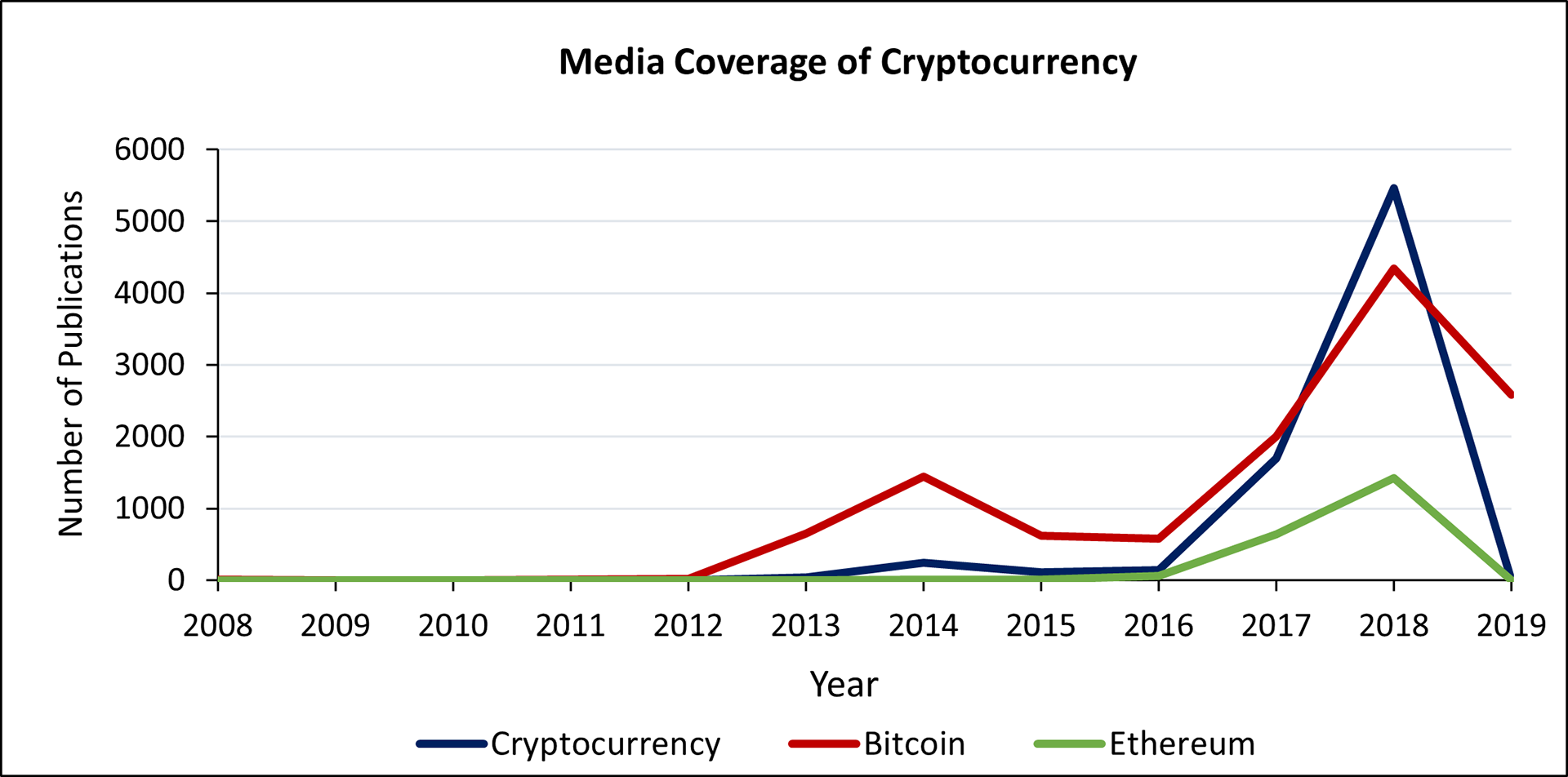

Figure 1. Canadian media coverage of cryptocurrency, Bitcoin, and Ethereum. This figure shows the total number of publications about popular digital currency topics from 1 January 2008 to 31 December 2018.

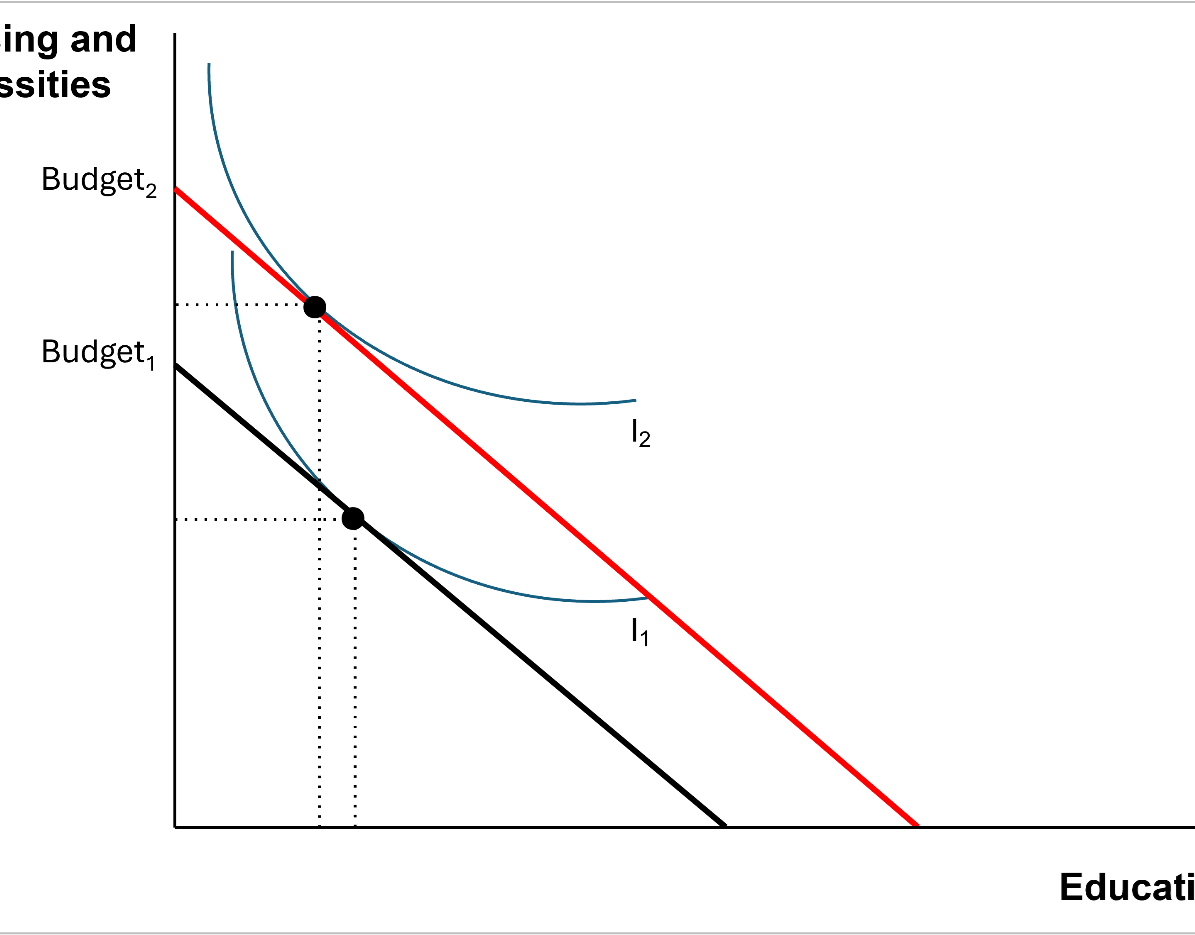

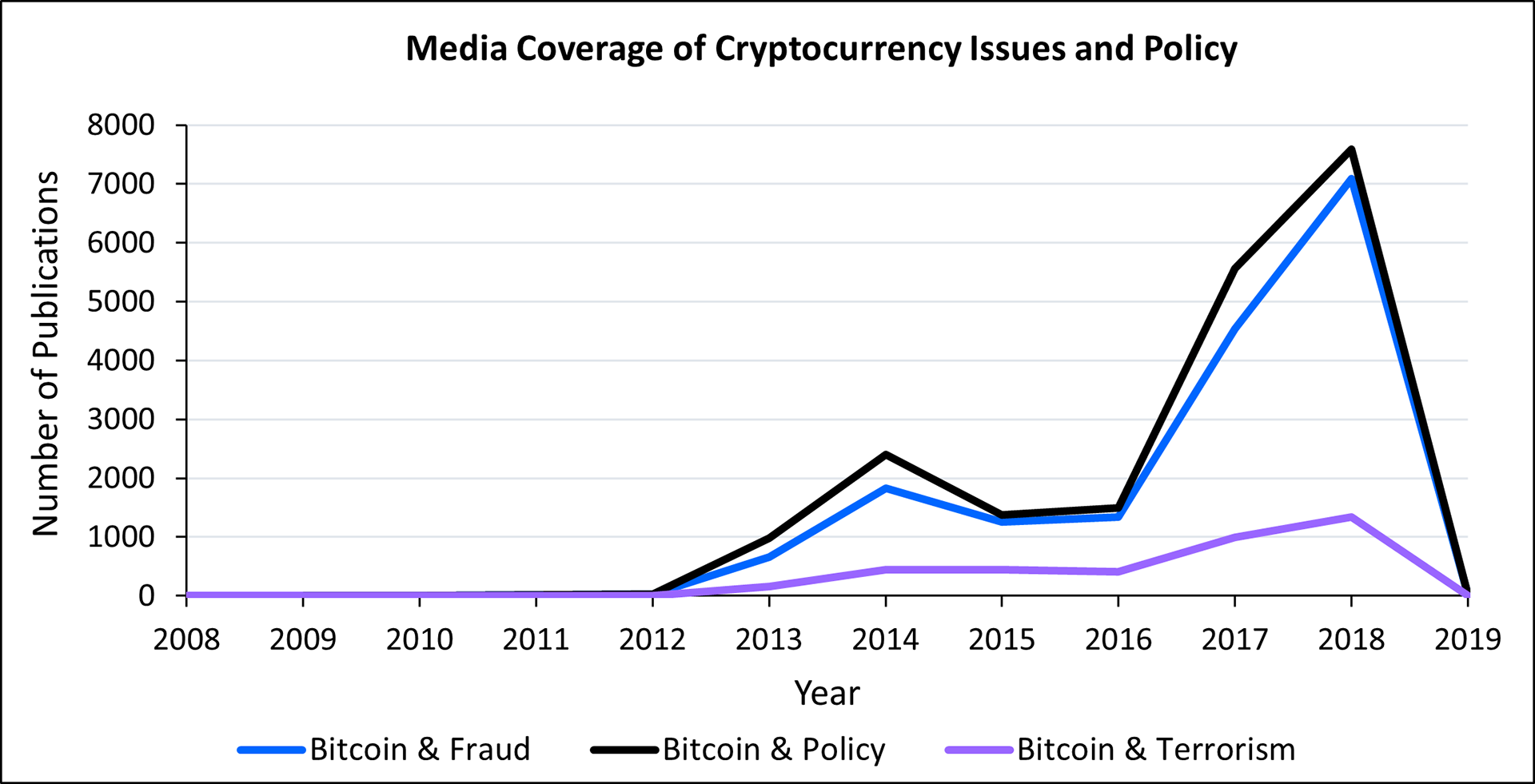

Figure 2. Canadian media coverage of the terms "Bitcoin and fraud", "Bitcoin and policy", and "Bitcoin and terrorism". This figure displays the total number of publications addressing concerns about fraud and terrorism from 1 January 2008 to 31 December 2018.

Figure 3. Schematic analysis of key events using Kingdon’s multiple streams model Source: Factiva

Policy of Interest

Proceeds of Crime (Money Laundering) and Terrorist Financing Act in 2019 under Bill C-31 (PCMLTFA)

Background

First created in 2009 by a pseudonymous character named Satoshi Nakamoto, Bitcoin was the first decentralized currency not affiliated with any government organization (Brito & Castillo, 2013). It operates as a peer-to-peer network electronic cash system, enabling secure currency exchange without the involvement of centralized agencies such as banks and governments. Instead, Bitcoin relies on distributed ledgers across computers worldwide for transactions (Conley et al., 2015).

The absence of a centralized database is the main security feature of Bitcoin. Its distributed database makes it extremely difficult to hack, due to the blockchain's strong encryption and cryptographic techniques (Tapscott & Tapscott, 2016). This has made Bitcoin popular in countries like Argentina, where capital mismanagement is an issue. In fact, the demand for bitcoins in Argentina is so high that bitcoin exchanges are planning to open offices in the country (Brito & Castillo, 2013). Cryptocurrencies are an exciting innovation that have attracted considerable interest from both professional and casual investors. The growing interest in Bitcoin and cryptocurrencies has sparked concerns about monetary policy and the importance of safeguarding the public interest and mitigating criminal activities that exploit the decentralized nature of these currencies.

This paper examines the evolution of the Canadian government's policy agenda by analyzing media trends and uses John Kingdon's multiple streams framework to explain how participants, focusing events, and public opinion contributed to the current state of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act in 2019, as outlined in Bill C-31.

Data and Methodology

The primary tool was Factiva, where several key terms were used to identify media mentions related to Bitcoin in the years before the 2019 amendment of the PCMLTFA (Table 1). This gave us insight into the rising popularity and interest surrounding Bitcoin.

Search Terms

Bitcoin, cryptocurrency, Ethereum, Bitcoin and fraud,

Bitcoin and terrorism, Bitcoin and policy

Bitcoin and terrorism, Bitcoin and policy

Time Period

2008/01/01 to 2019/01/01

Language

English

Application of Kingdon’s Multiple Streams Framework

Following Kingdon’s framework (1995), several indicators within the problem stream drew international attention and prompted the call for action in regulating cryptocurrency to mitigate terrorist financing and money laundering (Figure 3). In 2015, the European Conference on Information Systems emphasized the importance of law enforcement agencies connecting cryptocurrency transactions with identities to detect illegal activities (Brenig et al., 2015). It also recommended that governments impose higher penalties for money laundering, which may include prosecution and conviction. Between 2016 and 2018, there was a marked media interest in cryptocurrency (Figure 1). According to a survey conducted in Canada, the ownership of Bitcoin among Canadians increased from 3.2% in 2016 to 4.3% in 2017 and further to 5.2% in 2018 (Balutel et al., 2023). Of the people surveyed, a majority reported owning Bitcoin for investment purposes. The increasing ownership of Bitcoin and other cryptocurrencies may have raised awareness among policymakers and regulatory agencies worldwide.

Additionally, between 2017 and 2018, there was a notable increase in media coverage of Bitcoin and fraud cases worldwide (Figure 2). The head of financial intelligence at Europol publicly stated that they believed cryptocurrencies were becoming increasingly involved in money laundering operations in Europe (Crisp, 2018). The focal event was the emergence of several media reports that revealed organizations like the Islamic State terrorist group were using cryptocurrencies for financing terrorism (Bronskill, 2018). Because Bitcoin is a decentralized economy, regulating illicit transactions is impossible (Song et al., 2023). Consequently, there were more press releases regarding other countries implementing policies and anti-money laundering measures. This heightened political and public concern over financial crime and illicit transactions related to cryptocurrencies was a clear indicator that led to increased pressure on the Canadian government to develop anti-money laundering policies that specifically addressed cryptocurrency.

According to Kingdon (1995), within the policy stream, the Royal Canadian Mounted Police (RCMP) acted as policy entrepreneurs in playing a key role in pushing for the inclusion of cryptocurrency exchange in the amendment of the PCMLTFA on the federal agenda. The RCMP had regularly conducted extensive research on cryptocurrencies and Bitcoin, with a focus on preventing crimes associated with these technologies (Posadzki, 2014). To counter money laundering, they drafted regulations for the PCMLTFA to cover the illicit exchange of Bitcoin. The proposed policy legally required individuals and businesses to record cryptocurrency transactions of $10,000 or more. Additionally, businesses engaged in cryptocurrency transactions would be required to register with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), which serves as the financial intelligence unit and anti-money laundering agency. By researching cryptocurrencies and their potential for money laundering, as well as actively advocating for and drafting policies for the federal government, the RCMP made a significant contribution in bringing government attention to this issue.

Conclusion

This paper concludes that the ownership of Bitcoin and media coverage of Bitcoin-related fraud and illicit transactions led to the Canadian government amending the PCMLTFA in 2019. The RCMP played a key role in drafting policy recommendations. This research emphasizes the importance of media trends and stakeholder involvement in shaping policies on cryptocurrencies and anti-money laundering measures.

Limitations

The analysis only focused on media trends and did not consider other factors that may have influenced the Canadian government's decision to amend the PCMLTFA. The study relied on publicly available data in English and as a result, may not have captured all relevant information. Additionally, the study mainly examined the Canadian context and may not be applicable to other countries or regions.

References

Balutel, D., Felt, M.-H., Nicholls, G., & Voia, M.-C. (2023). Bitcoin awareness, ownership and use: 2016–20. Applied Economics. Retrieved from https://doi.org/10.1080/00036846.2023.2166667

Brenig, C., Accorsi, R., & Müller, G. (2015). Economic Analysis of Cryptocurrency Backed Money Laundering. ECIS 2015 Completed Research Papers (pp. 1-11). Retrieved from https://aisel.aisnet.org/ecis2015_cr/20

Brito, J., & Castillo, A.M. (2013). Bitcoin: A Primer for Policymakers.

Bronskill, J. (2018, June 19). Feds take aim at terrorist use of cryptocurrencies, prepaid cards. The Canadian Press via Financial Post. Retrieved from https://financialpost.com/pmn/business-pmn/feds-take-aim-at-terrorist-use-of-cryptocurrencies-prepaid-cards

Conley, B., Echert, J., Fuller, A., Lewis, H., & Lunday, C. (2015). Cryptocurrencies: An Introduction for Policy Makers. Retrieved from https://digitalcommons.law.uw.edu/techclinic/13

Crisp, W. (2018, December 29). Financial crime: the new battlefield. The Telegraph. Retrieved from https://www.telegraph.co.uk/business/2018/12/29/financial-crime-new-battlefield/

Kingdon, J. W. (1995). Agendas, Alternatives, and Public Policies. HarperCollins.

Tapscott, D., & Tapscott, A. (2016). Blockchain Revolution: How the Technology Behind Bitcoin is Changing Money, Business, and the World. Penguin.

Song, Y., Chen, B., & Wang, X. Y. (2023). Cryptocurrency technology revolution: are Bitcoin prices and terrorist attacks related?. Financial Innovation, 9(1), 29. https://doi.org/10.1186/s40854-022-00445-3

Posadzki, A. (2014, September 10). RCMP studying Bitcoin to help solve crimes, emails show. Global News. Retrieved from https://globalnews.ca/news/1556290/rcmp-studying-bitcoin-to-help-solve-and-prevent-crimes/