Table 1. Key stakeholders in the e-CNY initiative.

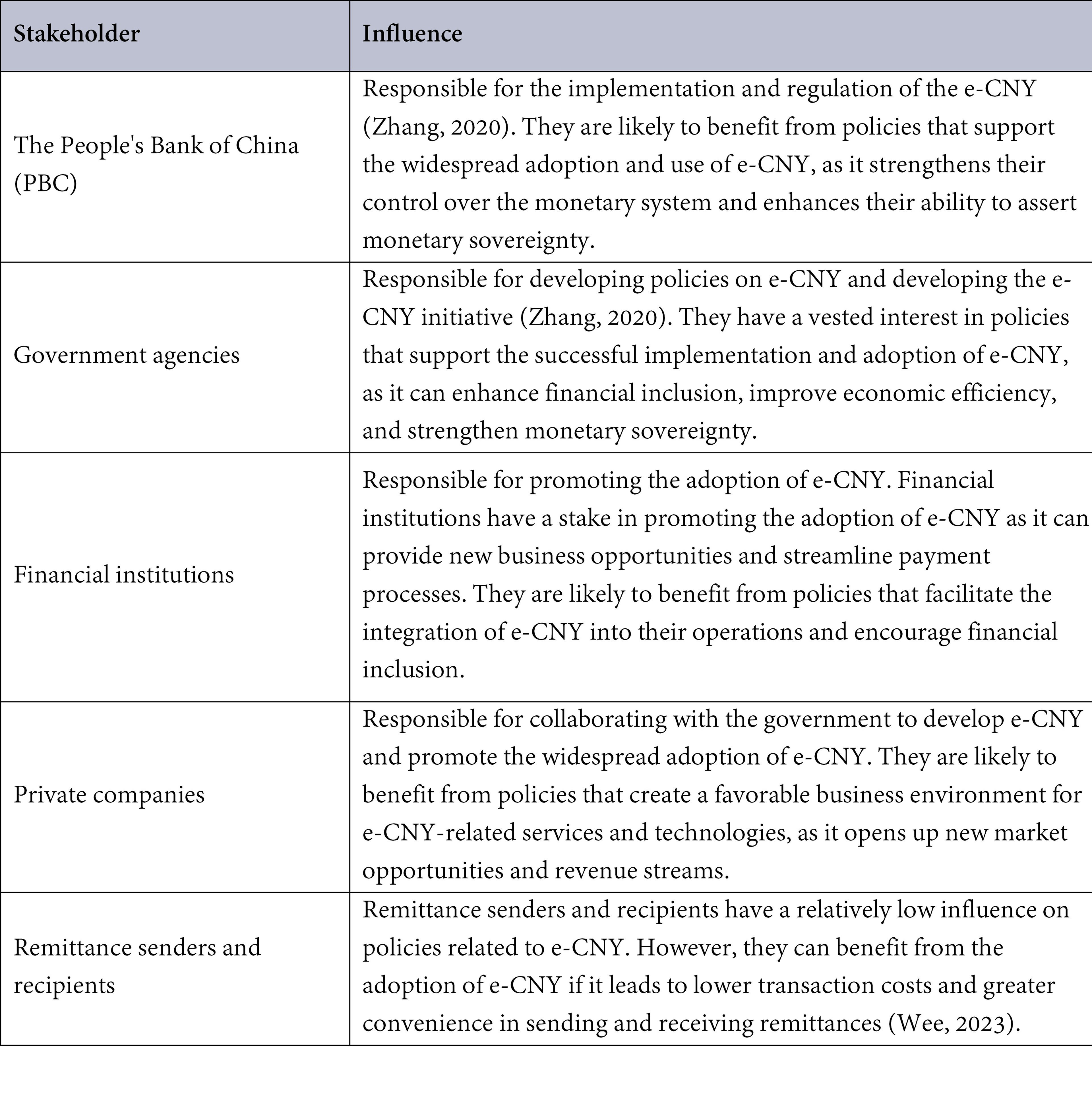

Figure 1. Remittances as a percentage of GDP in the top countries with the highest GDP contribution from remittances compared to China and Canada in 2022. Source: The World Bank. (2023).

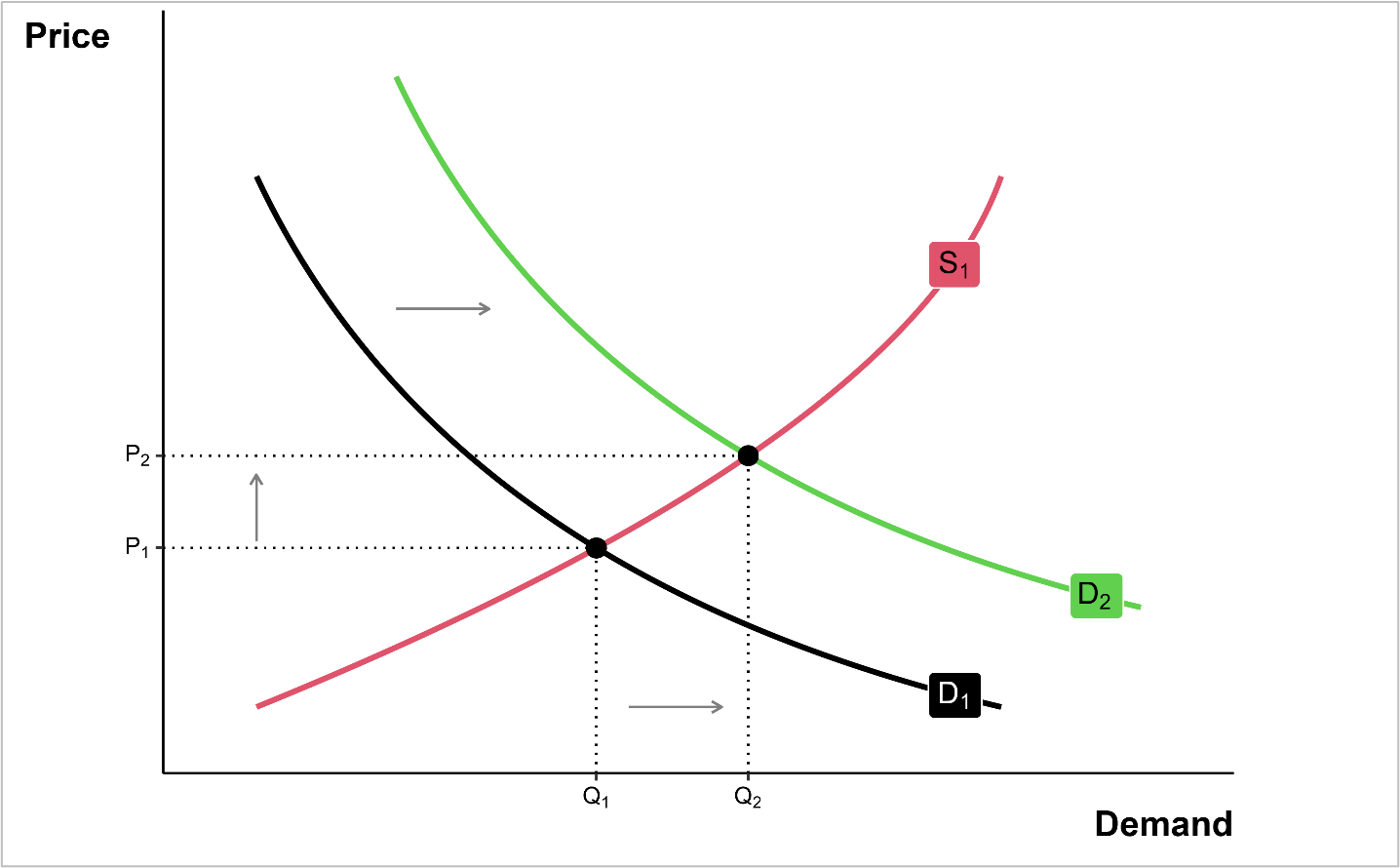

Figure 2: Supply and demand curve of remittances. The demand curve (D1) for remittances shifts to the right (D2), indicating an increase in the quantity of remittances individuals are willing to demand. This is attributed to the ease and accessibility of using e-CNY for remittance transactions, which attracts more individuals to engage in remittance transfers.

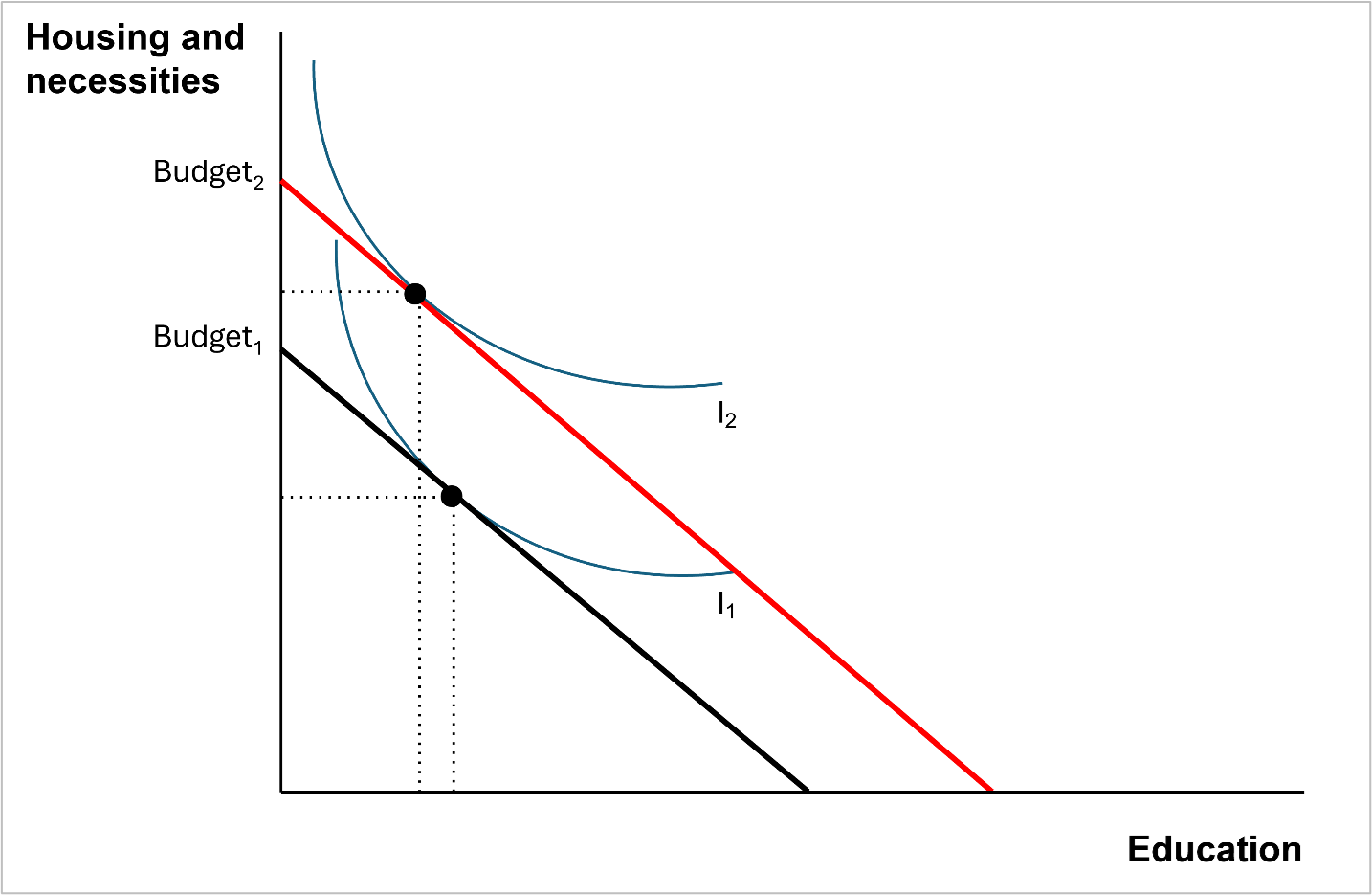

Figure 3: Indifference curves representing the relationship between two budgets. Budget 1 (no remittances) and Budget 2 (with remittances). The curve shows a decrease in education spending and an increase in expenditure on housing and necessities. The shift in spending patterns indicates a potential trade-off between investing in education and addressing immediate needs.

An Analysis of the Introduction and Impact of the e-CNY in China: Promoting Financial Inclusion and Reducing Remittance Costs

Elaine Huang

UBC School of Public Policy and Global Affairs

PPGA 500A 2023W1: Economics for Policy

Dr. Jonathan Graves

December 12, 2023

December 12, 2023

Executive Summary

The research explores the introduction of Central Bank Digital Currencies (CBDCs), specifically focusing on the case of the e-CNY in China. It addresses the challenges of high remittance fees and limited financial accessibility and discusses how CBDCs, like e-CNY, can overcome these challenges. The e-CNY initiative aims to reduce remittance costs, improve transactional efficiency, and enhance financial inclusion. By leveraging digital technologies, e-CNY enables affordable remittance transactions for low to middle-income households and provides access to banking services in rural areas. It emphasizes the importance of CBDCs in promoting financial inclusion, reducing costs, and enhancing the well-being and economic growth of individuals and communities reliant on remittance transactions. The research also outlines possible approaches, including the introduction of CBDCs, education and awareness initiatives, and public-private partnerships. It further discusses the implications of CBDCs on public goods, welfare, and the efficiency of the financial system, as well as budget constraints. The findings indicate that CBDCs, particularly e-CNY, have the potential to foster a more inclusive and socially efficient economy by improving financial accessibility and reducing remittance costs.

The research explores the introduction of Central Bank Digital Currencies (CBDCs), specifically focusing on the case of the e-CNY in China. It addresses the challenges of high remittance fees and limited financial accessibility and discusses how CBDCs, like e-CNY, can overcome these challenges. The e-CNY initiative aims to reduce remittance costs, improve transactional efficiency, and enhance financial inclusion. By leveraging digital technologies, e-CNY enables affordable remittance transactions for low to middle-income households and provides access to banking services in rural areas. It emphasizes the importance of CBDCs in promoting financial inclusion, reducing costs, and enhancing the well-being and economic growth of individuals and communities reliant on remittance transactions. The research also outlines possible approaches, including the introduction of CBDCs, education and awareness initiatives, and public-private partnerships. It further discusses the implications of CBDCs on public goods, welfare, and the efficiency of the financial system, as well as budget constraints. The findings indicate that CBDCs, particularly e-CNY, have the potential to foster a more inclusive and socially efficient economy by improving financial accessibility and reducing remittance costs.

Problem Statement: The high fees associated with remittances, coupled with the requirement for physical access to financial institutions, pose obstacles to the efficient transfer of funds. These challenges directly affect the well-being and economic progress of vulnerable populations, creating barriers to financial inclusion and hindering overall economic growth. The introduction of the e-CNY addresses the problem by reducing remittance costs, improving transactional efficiency, and enhancing financial accessibility for individuals and communities dependent on remittance transactions. The e-CNY has zero transaction fees, making remittance transactions more affordable for low to middle-income households (BIS, 2020). The e-CNY allows rural areas to participate in remittance transactions without the need for physical access to financial institutions. Education and awareness initiatives create a better understanding of CBDCs, fostering trust and cooperation among individuals and institutions. Public-private partnerships and regulations will ensure the efficient provision of remittance services and the successful adoption of the e-CNY.

Possible Approaches:

Introduction of CBDCs: The e-CNY can provide a digital form of currency that is accessible to all individuals and can be used for remittance transactions. By eliminating transaction fees and the need for physical access to financial institutions, e-CNY can reduce costs, improve efficiency, and enhance financial inclusion.

Education and Awareness Initiatives: Promoting awareness and providing education about the benefits and usage of e-CNY can increase adoption and acceptance among individuals and communities. Clear and easily understandable information should be disseminated to address concerns regarding security, privacy, and the advantages of e-CNY.

Public-Private Partnerships: Collaborating with private entities can leverage their expertise and resources in developing and maintaining the e-CNY infrastructure. Public-private partnerships can ensure the efficient provision of remittance services and enhance the overall effectiveness of e-CNY implementation.

Policy Options

The e-CNY aims to tackle the challenges presented by existing cryptocurrencies and preserve monetary sovereignty. While alternatives like relying solely on traditional fiat currency do not enhance financial inclusion in regions with limited bank access, embracing cryptocurrencies such as Bitcoin is viewed as a risk to monetary sovereignty by countries like China. Therefore, e-CNY offers an attractive alternative to these policy options. CBDCs provide countries with the monetary sovereignty they desire while also improving financial inclusion, similar to other digital currencies.

Background

The decentralized nature of Bitcoin presents a challenge to the conventional role of central banks and has garnered attention in countries struggling with issues of capital mismanagement. The demand for bitcoins in Argentina is significant, leading to preparations for establishing Bitcoin exchange offices (Brito & Castillo, 2013). Cryptocurrencies have garnered significant attention from both professional and casual investors due to their innovative nature. In Canada, the ownership of Bitcoin increased from 3.2% in 2016 to 4.3% in 2017 and further to 5.2% in 2018 (Balutel et al., 2023). The growing popularity of cryptocurrencies like Bitcoin presents challenges to traditional central banks' control over money and raises concerns about monetary sovereignty. Decentralized cryptocurrencies, while offering innovative security features, also pose risks such as potential criminal activities like terrorist financing and money laundering (Crisp, 2018). China took decisive action by implementing a complete ban on cryptocurrencies and introduced their own digital currency, known as e-CNY, in order to establish authority over their monetary system (Huang & Mayer, 2022). This proactive approach allows China to maintain its monetary authority while addressing the issue of financial inclusion. The aim of this paper is to analyze the economic implications, financial stability, transaction efficiency, and potential risks associated with the adoption of e-CNY in China.

Central Bank Digital Currency (CBDC) revolutionizes financial services by providing equal access to basic financial tools, even in remote rural areas (Tapscott & Tapscott, 2016). It allows individuals to securely store, transfer, and utilize currency, connecting them to the global economy with the assurance and protection of the Chinese government. By granting legal ownership of the digital currency, e-CNY empowers individuals who have been excluded from the global economy due to strict financial institution rules and limited access to bank accounts. e-CNY can create a more inclusive financial sector, particularly in rural areas with lower income and limited access to financial services (Chuc et al., 2021). A socially efficient economy thrives when it benefits everyone, and e-CNY plays a pivotal role in promoting financial inclusion and reducing the exorbitant costs associated with remittance transfers (Tapscott & Tapscott, 2016). By eliminating the need for intermediaries like Western Union, e-CNY redirects billions of dollars annually back to individuals and their communities. Furthermore, e-CNY removes barriers to obtaining bank accounts, accessing credit, and engaging in investments, thereby fostering entrepreneurship and enabling active participation in global trade.

In 2020, China's Ministry of Commerce introduced a pilot program for the Digital Currency Electronic Payment (DCEP), also known as the digital RMB or digital yuan (e-CNY) initiative (Zhang, 2020). Developed by the state-owned Bank of China, e-CNY is the digital version of the Chinese yuan and functions as legal tender. The objective of the e-CNY initiative is to address challenges by offering a regulated centralized digital currency instead of cryptocurrencies, allowing China to assert its monetary sovereignty (Huang & Mayer, 2022). In addition to this, the implementation of e-CNY serves as an antitrust policy by limiting the influence of major cryptocurrencies like Bitcoin and Ethereum, following the ban on cryptocurrency transactions in September 2017 (Chen & Liu, 2022; CORE, 2017). Furthermore, e-CNY and other Central Bank Digital Currencies (CBDCs) are theoretically effective in reducing tax evasion, as they utilize a government-operated ledger to track transaction histories. According to the Ministry of Commerce of China, the initial regions selected for testing this new monetary policy were Chengdu, Shenzhen, Suzhou, and Xiong'an (Zhang, 2020).

The e-CNY project in China is currently one of the first and largest CBDC initiatives in the world, attracting significant international interest (Laboure et al., 2021). Given China's sizable population, there is a significant opportunity to establish a substantial user base for e-CNY. Additionally, e-CNY holds significant potential in bridging the gap in financial accessibility between urban and rural areas (Zhu et al., 2020). By improving financial service accessibility and simplifying the remittance process, e-CNY and other CBDCs can promote economic growth and enhance the well-being of rural communities, fostering a more inclusive and socially efficient economy.

Issues Presented:

Remittance costs and limited financial accessibility: High fees and the need for physical access to financial institutions hinder the efficient transfer of funds through remittances, affecting the well-being and economic growth of vulnerable populations.

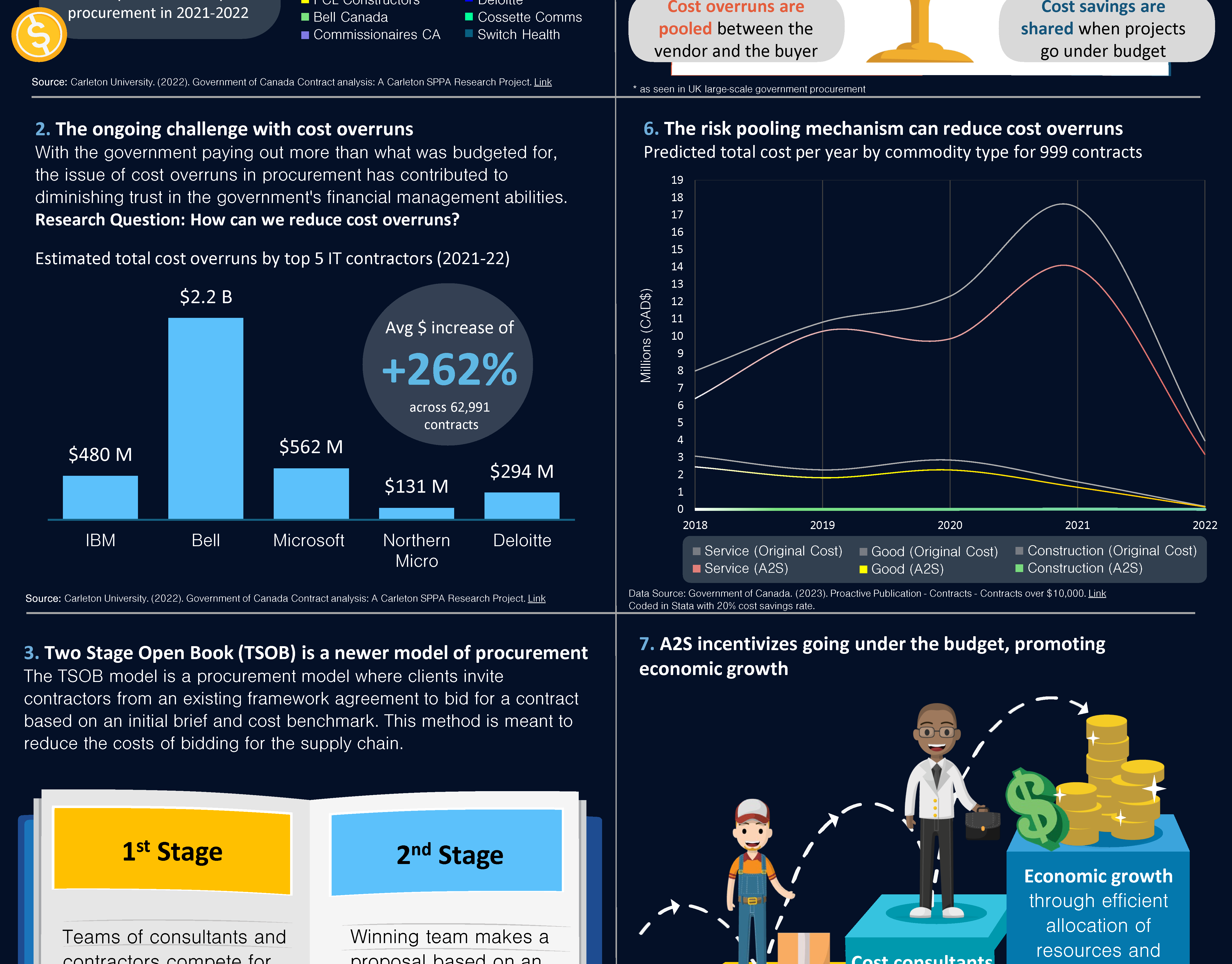

Public goods and strategic incentives: CBDCs are public goods, and offering incentives or rewards to individuals who use CBDCs can encourage participation and cooperation. Regulations will need to be made to protect the interests of the various stakeholders involved (Table 1).

Budget constraints: Remittances provide individuals with additional financial resources, but their impact on education and growth depends on the allocation of funds. Remittance-receiving households may allocate a smaller portion of their budget toward education expenditure, which could have long-term negative consequences.

I. The Impact of Central Bank Digital Currency (CBDC) on the Remittance Industry: Fostering Financial Inclusion and Reducing Costs

The remittance industry plays a crucial role in the global economy by facilitating the transfer of funds between different geographical locations. However, these money transfers often come with high fees and involve multiple intermediaries to move the money from one account to another (Tapscott & Tapscott, 2016). As a result, billions of dollars are spent annually on remittance fees. Furthermore, many recipients of these money transfers have to travel long distances to reach a financial institution to receive the money. According to the World Bank, remittances accounted for 0.1% of China's GDP in 2022 (Figure 1). In economically disadvantaged countries, remittances constitute a substantial portion of the GDP and enable individuals to meet their basic needs, providing a lifeline for those facing economic hardships (Tapscott & Tapscott, 2016). For instance, in the Republic of Tajikistan (TJK), remittances made up 50.9% of the GDP, while in Tonga, remittances accounted for 46.2% of the GDP (The World Bank, 2023). The People's Bank of China (PBC) does not charge authorized operators or individual users for using e-CNY, making it a preferred choice compared to other money transfer services (BIS, 2020). Despite being in the early stages of adoption, e-CNY has gained significant popularity as a preferred method for domestic retail payments due to its high demand (Wee, 2023). By the end of June 2023, transactions using e-CNY had reached $249.33 billion, a significant increase from the 100 billion yuan recorded in August of the previous year. As of July 2023, there have been 950 million e-CNY transactions and a total of 120 million wallets opened, demonstrating the growing acceptance of e-CNY among the public. The adoption of e-CNY is still in its early stages, with the circulation of e-CNY currently accounting for only 0.16% of China's total money supply or cash in circulation. However, there is significant potential for further growth and expansion in the future.

The Role of e-CNY in Increasing Remittance Supply

The widespread adoption and elimination of transaction costs, along with the requirement for an internet connection, can have a positive influence on the movement of remittances concerning e-CNY. On the supply side, the introduction of e-CNY can reduce costs and improve the efficiency of sending remittances. Since there are no transaction fees, individuals can digitally send money using e-CNY without incurring extra charges, making it a more appealing option (BIS, 2020). By eliminating transaction fees, more individuals, particularly those in the low to middle-income bracket, are incentivized to use formal financial services and send remittances, promoting greater financial inclusion (Chuc et al., 2021). Additionally, the People's Bank of China (PBC) has implemented initiatives to promote the widespread adoption of e-CNY by incentivizing the public to use the digital currency (Allen et al., 2022). One example is the use of a lottery system in pilot programs to distribute e-CNY. By offering these incentives, the PBC aims to encourage the public to embrace and actively use e-CNY. This can result in an increase in the supply of remittances, as more people find it easier and more convenient to send money through e-CNY. Consequently, the remittance supply curve may shift to the right, indicating a higher quantity of remittances supplied at each price level.

Impact of e-CNY on Demand for Remittance Transactions

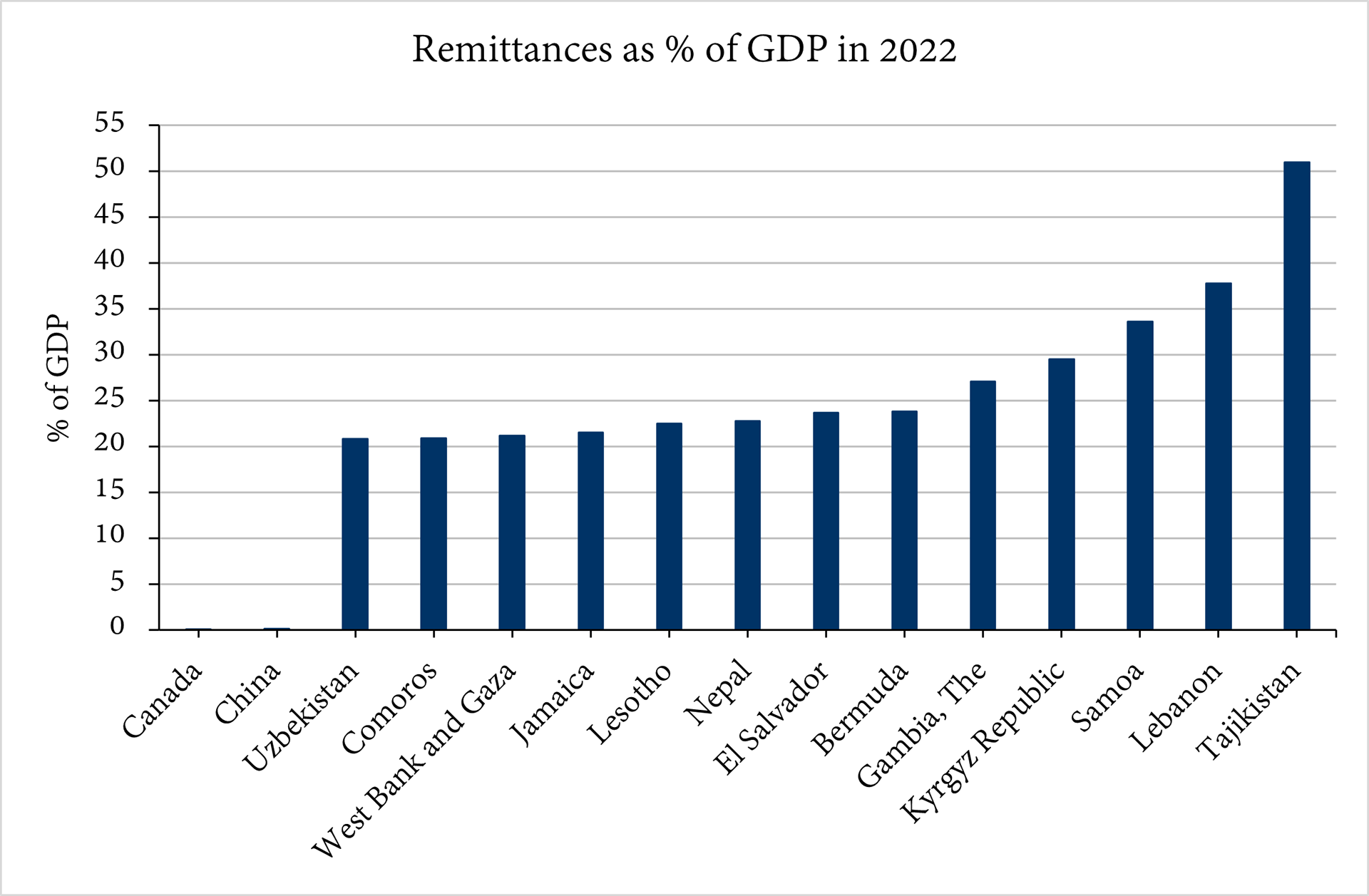

On the demand side, the ease and accessibility of sending remittances through e-CNY can lead to an increase in demand (Figure 2). Digital currencies usually require an internet connection to access and transfer funds, which makes internet access necessary for financial accessibility. However, a study conducted in 2017 found that the internet penetration rate was only 34%, indicating that a significant portion of the population lacks internet access (Zhu et al., 2020). The e-CNY addresses this issue by not requiring an internet connection to access and transfer funds. Instead, it utilizes NFC technology, which is already used in popular payment methods like Apple Pay (He et al., 2023). NFC wallets are particularly beneficial for those living in remote areas with limited network connectivity. The e-CNY's lack of dependency on a Wi-Fi network allows individuals in areas with limited internet connectivity to participate in remittance transactions. This feature also benefits the elderly and disabled who struggle to access banks and the internet (Mu, 2023). The improved accessibility can attract more users to engage in zero-cost remittance transactions. As a result, the demand curve for remittances may shift to the right due to an increase in demand.

With its high adoption rate, absence of transaction costs, and independence from the need for a Wi-Fi network, e-CNY can boost both the supply and demand for remittances. The e-CNY enhances the accessibility of remittance services by eliminating transaction fees and making it convenient for rural communities with lower digital literacy. Furthermore, the digital nature of the e-CNY enables quick transfer and receipt of remittances (Gascón et al., 2023). As a result, it is expected that the quantity of remittances sent and received will increase, leading to an improvement in the welfare and living standards of individuals who rely on these financial transfers.

On the supply side, e-CNY can lower costs and increase efficiency in sending remittances, leading to more remittances being sent. On the demand side, the ease and accessibility of e-CNY can increase the demand for remittances, especially among those excluded from the formal financial system. This can have a positive impact on the welfare and living standards of individuals relying on remittances, particularly in countries with a significant share of GDP coming from remittances.

II. The Impact of Remittances on Education and Budget Constraints in Rural China

Migration and remittances also influence incentives for individuals to invest in education and human capital, leading to long-term effects on consumption and savings decisions (Destrée, 2021). When individuals receive remittances from emigrated family members, they have more resources available to invest in education and training, resulting in increased human capital and improved future earning potential. This, in turn, can lead to higher levels of consumption and savings in the long run.

However, the impact of migration and remittances on education and growth is not unequivocally positive (Destrée, 2021). The empirical literature shows both positive and negative impacts of migration and remittances on economic growth. While remittances can boost individuals' overall income, they may also limit their ability to borrow and impact their allocation of funds, potentially exerting adverse effects on economic growth. A study conducted in 2016 found that households receiving remittances tend to allocate a larger portion of their budget towards essential needs such as housing or durable goods, rather than investing it (Démurger & Wang, 2016). In impoverished rural regions of China, households receiving remittances allocated a significantly smaller portion of their budget towards education expenditure (Figure 3). This observation may be attributed to a perceived lower value placed on education by the uneducated population. Although remittances may boost spending on essential goods, they can also lead to a decrease in investments in education, which could have negative consequences in the long term.

Conclusion

e-CNY is a promising initiative as it reduces remittance costs, improves efficiency, and promotes financial inclusion. It has the potential to have a positive impact on economic growth and bridge the gap between urban and rural areas. However, there may be budget limitations on investments in education due to increased access to funds. The successful implementation of e-CNY in China can serve as inspiration for other countries to adopt CBDCs and reshape the global financial system. To accurately identify the benefits and costs, empirical research needs to be conducted to quantitatively measure the effects of e-CNY on rural communities and the remittance market.

References

Allen, F., Gu, X., & Jagtiani, J. (2022). Fintech, Cryptocurrencies, and CBDC: Financial Structural Transformation in China. Journal of International Money and Finance. Link

Balutel, D., Felt, M.-H., Nicholls, G., & Voia, M.-C. (2023). Bitcoin awareness, ownership and use: 2016–20. Applied Economics. Link

BIS (June 2020). "E-CNY: main objectives, guiding principles and inclusion considerations." BIS Papers No 123, Bank for International Settlements. Link

Brito, J., & Castillo, A.M. (2013). Bitcoin: A Primer for Policymakers.

Chen, C., & Liu, L. (2022). How effective is China's cryptocurrency trading ban? Finance Research Letters, 46(Part B), 102429. Link

CORE Team. (2017). The Economy: Economics for a Changing World. Oxford University Press.

Crisp, W. (2018, December 29). Financial crime: the new battlefield. The Telegraph. Link

Démurger, S., & Wang, X. (2016). Remittances and expenditure patterns of the left behinds in rural China. China Economic Review. Link

Destrée, N., Gente, K., & Nourry, C. (2021). Migration, remittances and accumulation of human capital with endogenous debt constraints. Mathematical Social Sciences. Advance online publication. Link

Gascón, P., Larramona, G., & Salvador, M. (2023). The impact of digitalisation on remittances. Evidence from El Salvador. Telecommunications Policy. Link

He, T., Hou, L., Li, Y., Liu, Y., Zhang, H., & Chen, Y. (2023, June 28). Research on near field communication (NFC) technology of E-CNY hard wallet. Proceedings of the SPIE, 12720, 127200A. Link

Huang, J., Shen, Y., Chen, J., & Zhou, Y. (2022). Regional Digital Economy Development and Enterprise Productivity: A Study of the Chinese Yangtze River Delta. Regional Science Policy & Practice, 14(S2), 118–137. Link

Huang, Y., & Mayer, M. (2022). Digital currencies, monetary sovereignty, and U.S.–China power competition. Policy & Internet, 14, 324–347. Link

Laboure, M., Müller, H.-P., Heinz, G., Singh, S., & Köhling, S. (2021). Cryptocurrencies and CBDC: The Route Ahead. Global Policy, 12, 663–676. Link

Mu, C. (2023). Theories and Practice of exploring China's e-CNY. In Data, Digitalization, Decentralized Finance and Central Bank Digital Currencies. Link

Tapscott, D., & Tapscott, A. (2016). Blockchain Revolution: How the Technology Behind Bitcoin is Changing Money, Business, and the World. Penguin.

The World Bank (2006). Global Economic Prospects 2006. Economic Implications of Remittances and Migration. The International Bank for Reconstruction and Development / The World Bank. Link

The World Bank, World Development Indicators (2023). Personal remittances, received (% of GDP). Link

Wee, R. (2023, July 19). China's digital yuan transactions seeing strong momentum, says cbank gov Yi. Reuters. Link

Zhang, D. (2020, August 14). 商务部:在京津冀、长三角等具备条件试点地区开展数字人民币试点 新华网 [Ministry of Commerce: Launch digital renminbi pilot projects in qualified pilot areas such as Beijing-Tianjin-Hebei and the Yangtze River Delta]. Xinhua News Agency. Link